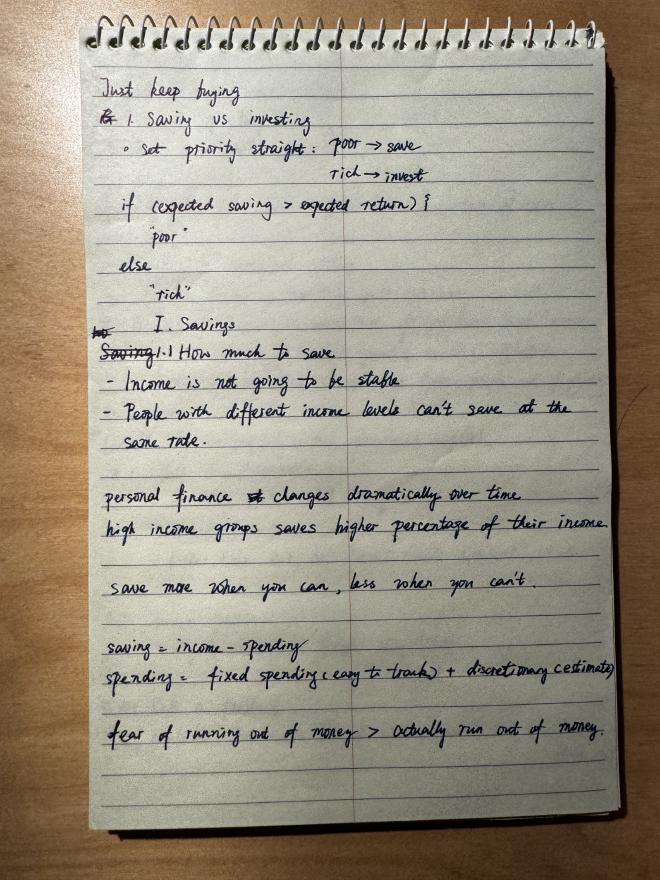

Just Keep Buying

Read in December 2023 and January 2024

0. Savings and Investing #

expected saving= money you can easily save in a yearexpected return= money you expect to get from existing investment

if (expected_saving > expected_return)

You are 'poor', focus on saving more

else

You are 'rich', focus on investing

1. Saving #

1.1 How much to save? #

Save more when you can, less when you can’t

- Income won’t be stable over the lifetime

- People with different income levels can’t save at the same rate: high income usually translate to higher savings rate

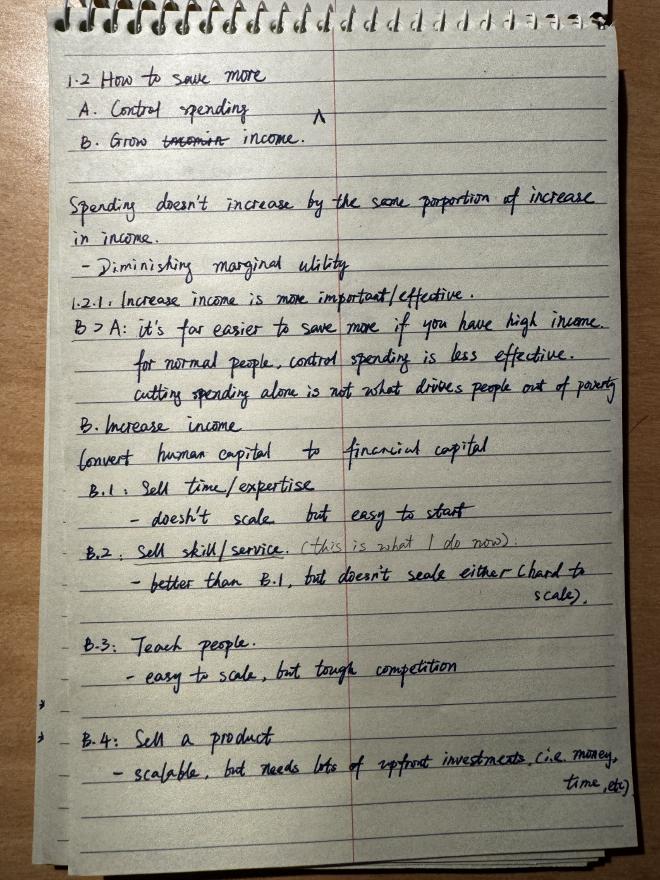

1.2 How to save more? #

Since Saving = income - spending:

a. Control spending

b. Grow income

Control spending

- Spending usually don’t increase by the same proportion of increase in income: diminished marginal utility

- Cutting spending is rarely what drives people out of poverty

Grow income

- Usually more effective than control spendings

- It is easier to save more when income is higher

1.2.1 How to grow income? #

Income is grown by converting human capital into financial capital

- Sell time/expertise: easy to start, doesn’t scale

- Sell skill/service: better than 1, still hard to scale

- Teach: tough competition, easy to scale

- Sell a product: high initial investment, easy to scale

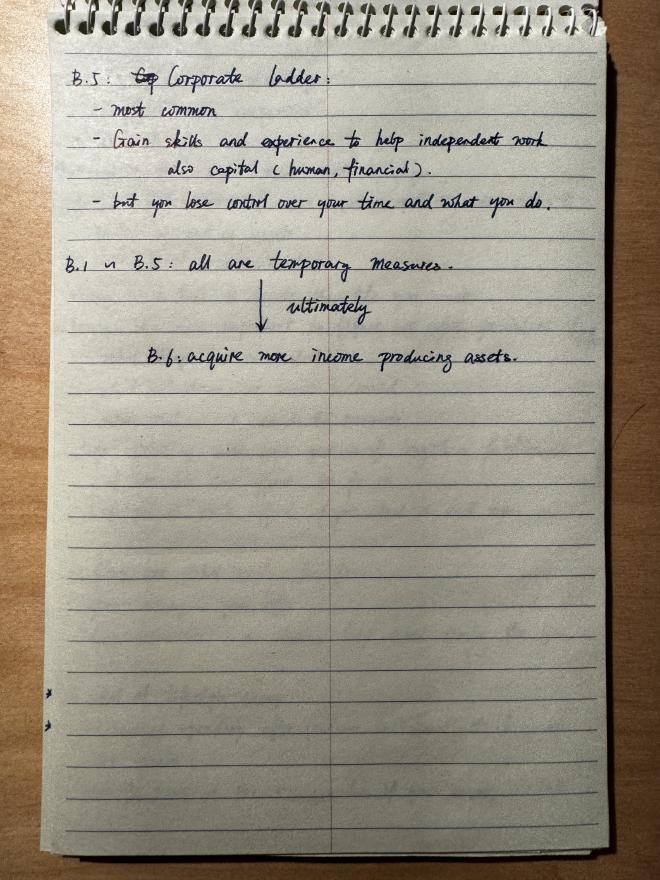

- Corporate laddering; most common, gain skills/experience in exchange of control over time and what to do

- Acquire more income producing assets: ultimate goal, 1 - 5 are all temporary in order to do 6

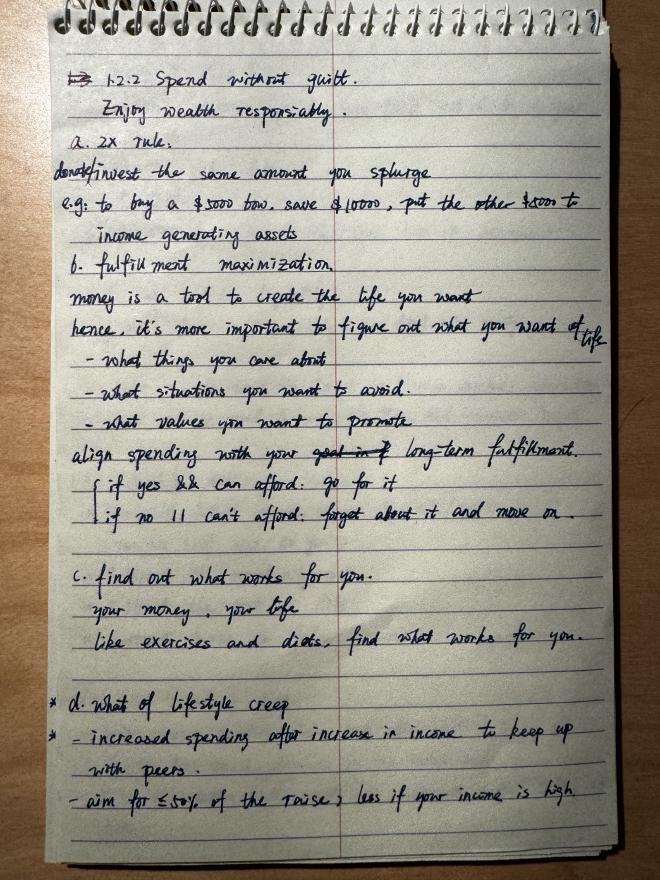

1.2.2 How to spending responsibly? #

Responsible spending brings contentment without guilt 1.2.2.1: 2X Rule:

- Invest the same amount we splurge in income producing asset 1.2.2.2: Fulfillment maximization:

- Money is a tool to create the life we want, spend on things that get us closer to what we want in life

- What things do you care about?

- What situations do you want to avoid?

- What values do you want to promote?

- Align spending with our long-term fulfillment:

if (algined AND canAfford) go for itif (notAligned OR cannotAfford) forget and move on1.2.2.3: Find what works for you

- It’s your money. Find what works for you personally 1.2.2.4: Lifestyle creep Increased spending after increase in income to keep up with peers

- Aim for

<= 50%of the raise, less if income is higher

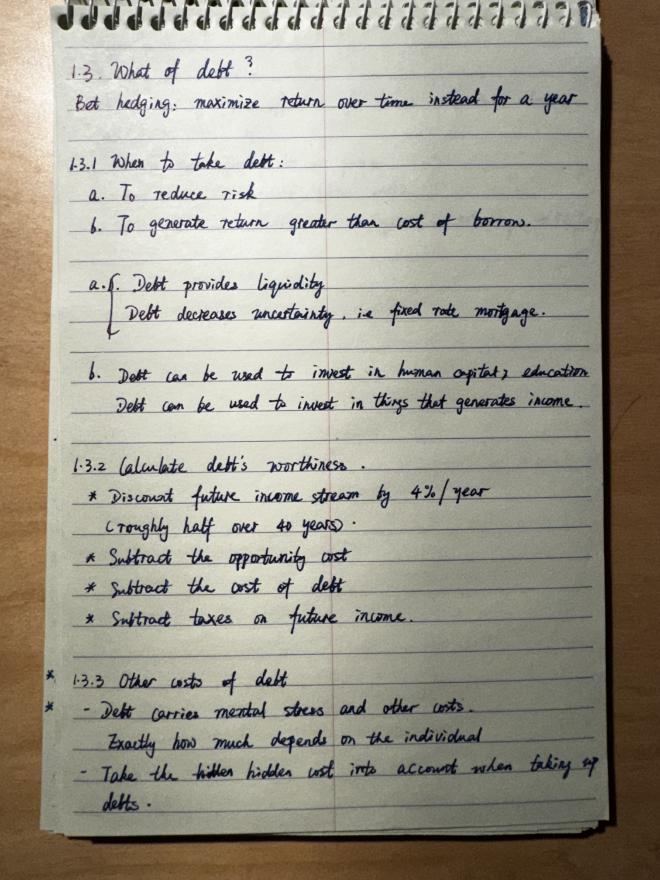

1.3 What of debt? #

Debt is not always bad.

1.3.1 When to take debt? #

- To reduce risk: debt provides liquidity, decreases uncertainty

- To generate return higher than the cost of borrowing

1.3.2 Calculate debt’s worthiness #

- Discount future income stream as a result of debt by

4%/year(roughly 50% over 40 years) - Subtract opportunity cost

- Subtract cost of debt

- Subtract taxes

1.3.3 Other costs of debt #

- Stress and emotional cost: exactly how much depends on individual

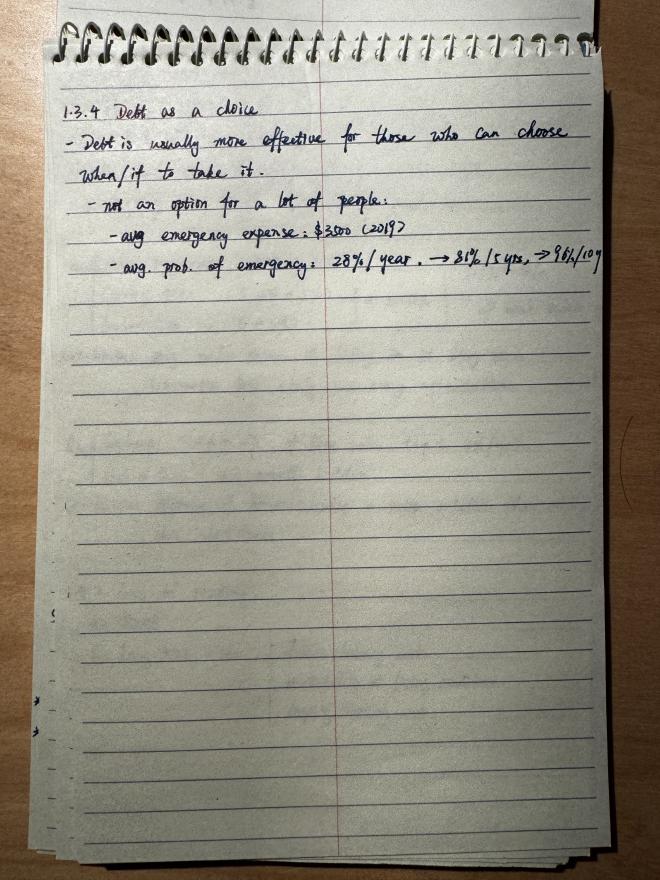

1.3.3 Debt as a choice #

- Debt is usually more effective for those who can choose when/if to take it

- Not an option for many people

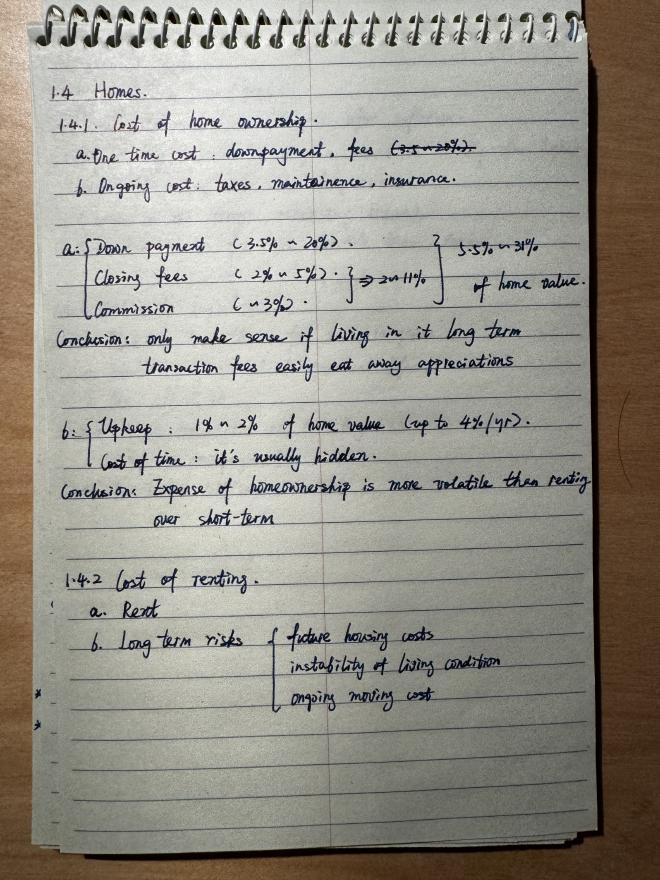

1.4 Home #

1.4.1 Cost of home ownership #

1.4.1.1 One time cost #

- Down payment:

3.5% - 20% - Closing fees:

2% - 5% - Commissions:

3%Total cost:5.5% - 31%of home value. It only makes sense if living in it long term. Transaction fees easily eats away appreciations.

1.4.1.2 Ongoing cost #

- Upkeep:

1% - 2% - Cost of time

Total cost:

~2%of home value per year. Expense of home ownership is more volatile than renting over the short term.

1.4.2 Cost of renting #

- Rent

- Long term risks

- Future housing costs

- Instability of living condition

- Ongoing moving cost

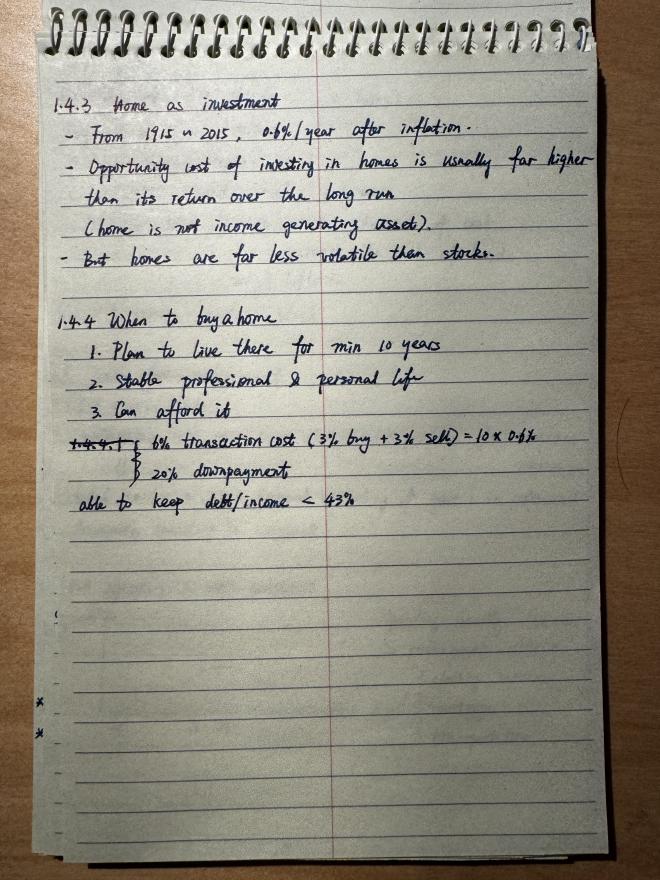

1.4.3 Home as investment #

- From 1915 - 2015, U.S homes appreciates

0.6%/yearafter adjusting for inflation - Opportunity cost of investing in home is usually far higher than its return over the long term: Home is not a incoming producing asset

- Home value is far less volatile than most other asset class

1.4.4 When to buy a home #

- Plan to live there for at least 10 years

- Stable professional and personal life

- Can afford it:

>= 20% down payment AND mortgage/income < 43%

1.5 How to saving for big purchases (e.g home) #

It depends on the time horizon: longer time horizon increases risks of cash, decreases risks of bond due to inflations

if (horizon <= 2 years)

Cash is king

else if (horizon > 2 years AND horizon < 5 years)

Bond over cash

else if (horizon > 5 years)

Consider a mix of bond + stock

1.6 Save for retirement #

1.6.1 The 4% Rule #

A point where you can withdraw 4% of a 50/50 stock/bond portfolio for at least 30 years: Total saving required = 25 x Annual spending of first year in retirement (if spending is constant)

1.6.2 Spending is not a constant #

- Data suggests spending usually decrease in retirement by about

1%/year- Lower needs for new clothing, services, transportations

- Mortgage is usually paid off

1.6.3 The cross over point rule #

A point where investment income > expense

- Total saving required = expense / return rate ~= 4% rule result

1.6.4 Retirement is more than just money #

- Finance is usually not the chief problem for retirees

- Fulfillment in retirement and health conditions (mental + physical) usually turn out to be the more important issues

- Money is a tool that solves a lot of problems, but it won’t solve the problem of your being

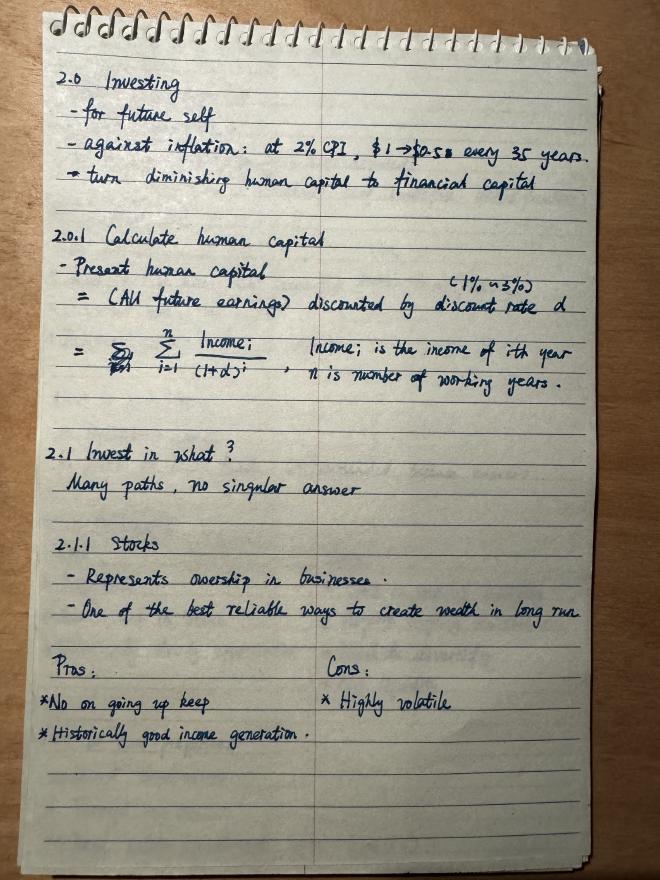

2. Investing #

- Investing is for our future selves

- Investing is a hedge against inflations: $1 deprecate by 50% over 35 years at 2% CPI

- Investing is turning diminishing human capital into financial capital

Human capital = All future earnings discounted by a discount rate (1-3%)

2.1 Invest in what? #

Many paths, no singular answer

2.1.1 Stocks #

- Represents ownership in businesses

- One of the best reliable ways to create wealth in the long term

Pros

- No ongoing up keeps

- Historically good income generation over the long term

Cons

- Highly volatile

How

- Buy individual stocks

- ETFs or index funds (recommended, cheap, easy, handsfree diversifications)

2.1.2 Bonds #

Pros

- Tends to rise when risky assets fall

- Consistent income generation

Cons

- Much lower return

How

- Buy individual bond

- ETFs or index funds (recommended, cheap, easy, handsfree diversifications)

2.1.3 Properties #

Pros

- Tangible

- Usually does not crash in value

- Historically steady appreciation

Cons

- It is an asset as well as a liability

- Require on going maintenance

- Hard to diversity

- Low liquidity

How

- Direct negotiations

- Through agents

2.1.4 Real estate invest trust (REIT) #

Pros

- Stock-like return

- Low correlation to stock

Cons

- Equal or greater volatility than stocks

2.1.5 Farmlands #

Pros

- Competitive compound return (7% - 9%) if well managed

- Low correlation to other assets

Cons

- Low liquidity

- Requires ongoing upkeep

How

- Direct buying

- Through REIT

2.1.6 Angel investing #

Pros

- High return (20% - 25%) Cons

- Most will lose

- Huge time commitment

- It’s more of a profession

2.1.7 Royalties #

Pros

- Steady income (5% - 20%)

- Low correlation to other assets

Cons

- High fees

- Tastes are hard to predict

How

- Buy individual stocks

- ETFs or index funds (recommended, cheap, easy, handsfree diversifications)

2.1.8 Your own products #

Books, services, information, etc

Pros

- Ownership

- Potentially high return

Cons

- Huge initial investment, no return guarantee

2.1.9 Gold, crypto, arts, etc #

- Values are based solely on perceptions

- Have no reliable income streams

- They are non-incoming generating assets

- Recommend make up < 10% of total investment portfolio

2.2 On buying individual stocks #

Only do it for fun. Put in what you are willing to lose Why?

- 75% professionally managed funds don’t beat market benchmark

- Insanely high volatility, emotional + time cost

2.3 How soon should you invest? #

Now: Most stock markets go up most of the time

2.3.1 Timing the market #

- Appealing in theory, difficult to practice

- Historically average-in underperforms all-in by 4%/year

- Average-in only over performs during crashes, crashes are pretty rare

- 60/40 all-in beats 100 average-in with the same risks: diversify by asset types instead of time

2.4 Never wait for the dip #

- Historically buying the dip under performs most of the time anyway

- You can’t predict the dip

2.5 Luck #

2.5.1 When you were born #

- There are good decades, there are bad decades

- Our birth time will shape what kind of return we can get regardless of investment strategy

- The act of investing itself is to mitigate against potential bad luck

2.5.2 The end is more important #

- Bad returns at the end of the time horizon is worse than bad returns at the beginning

- Personally 2055 - 2065 is the most important for me

2.5.3 Mitigate bad luck #

- Adequate diversification depending on time horizon

- Lower withdraw during downturn

- Supplement income by working part time

- Time is the best way of mitigating against bad luck

2.6 Volatility #

-

Volatilities are like ocean waves, you won’t get to the new world if you can’t stomach it.

-

Volatility is the admission fee of success

-

Stock will decline an average of 10.6% in any given year at some point

-

If max draw down > 15% for the year, it’s better to invest in bonds. But max draw down is impossible to know

2.6.1 What can we do? #

- Diversify

- Accept volatility

2.7 During a crisis #

If have investable cash on hand, crisis is the best time to invest. It takes more percentage growth to offset the same loss in dollar term.

2.8 When to sell #

a. To rebalance b. Get out of concentrated (or losing) positions c. To meet financial needs

2.8.1 Sell right away vs over time #

- Sell as late as possible: let money work in the market for as long as possible

- Buy quickly, sell slowly

2.8.a To rebalance #

Without rebalancing, portfolio asset mix will drift

- Usually stock outperforms bond in the long term

- Rebalancing usually reduces return but also reduces risks

How often to rebalance

- No perfect time, but start with annually: easy, save time, tax season

Better way to rebalance

- Don’t sell, buy more instead

- It reduces max drawn down compared to sell to rebalance

- Becomes harder when portfolio is large

2.8.b Get out of concentrated (or losing) positions #

- Concentrated positions is likely to underperform the market in the long term. Avg stock return 6.6% vs 9.9% of S.P500

- Don’t sell all at once (Tax!!)

- Sell based on a pre-defined rule and stick to it no matter what

2.8.c To meet financial needs #

Fund the life you need before risk it for the life you want

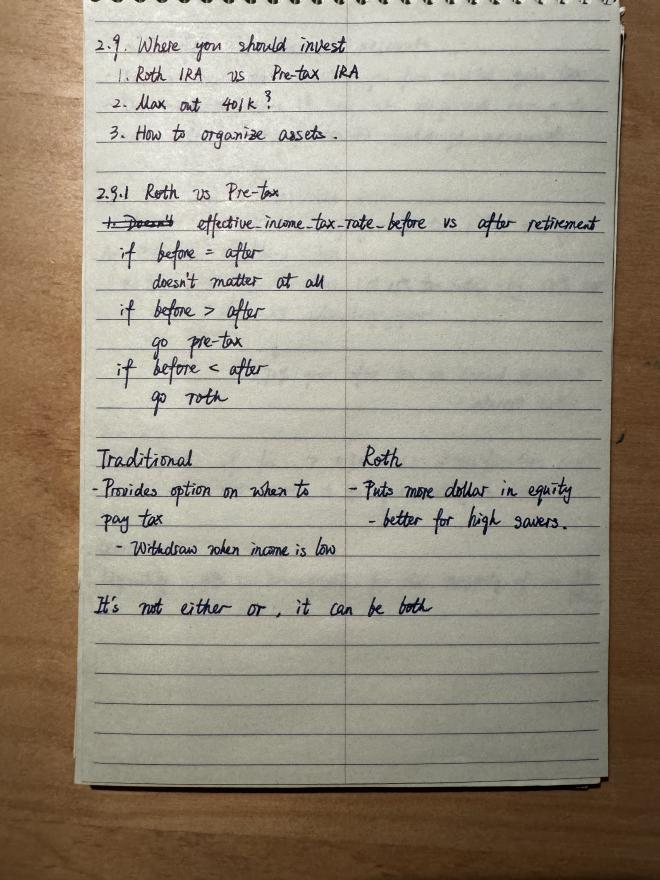

2.9 Where you should invest #

2.9.1 Roth vs pre-tax #

if tax_rate_before == tax_rate_after

does not matter at all

if tax_rate_before > tax_rate_after

go pre-tax

if tax_rate_before < tax_rate_after

go roth

if not sure

why not go both?

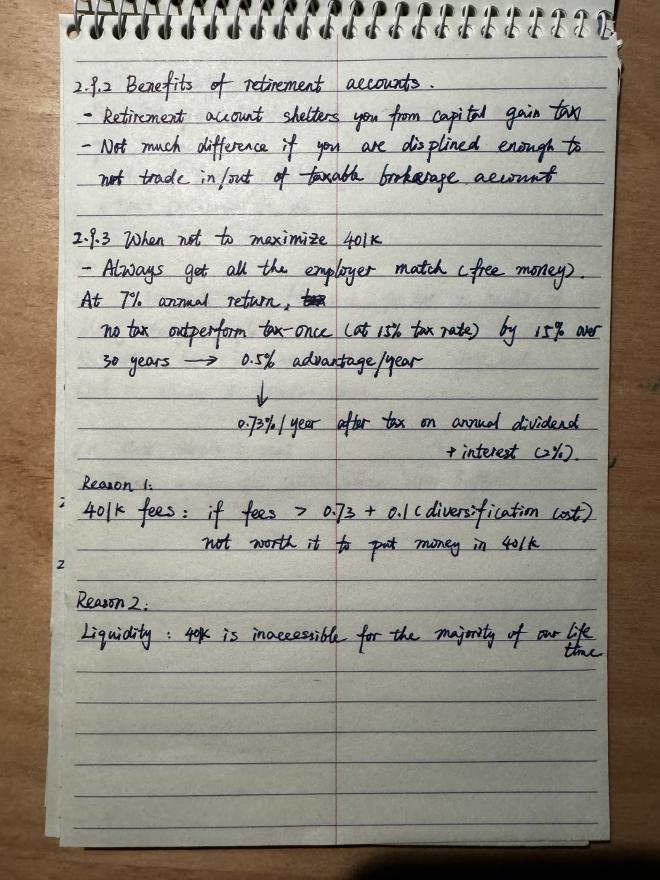

2.9.2 Benefits of retirement accounts #

- Shelters you from capital gain tax

- Not much difference to a taxable account if you are disciplined to not trade in/out frequently

2.9.3 When not to maximize 401k #

- Always get all your employer match, it’s free money

- If your 401k has high fees (>= 0.83%), the fee could offset all tax advantages

- 401k is effectively inaccessible for the majority of our life time

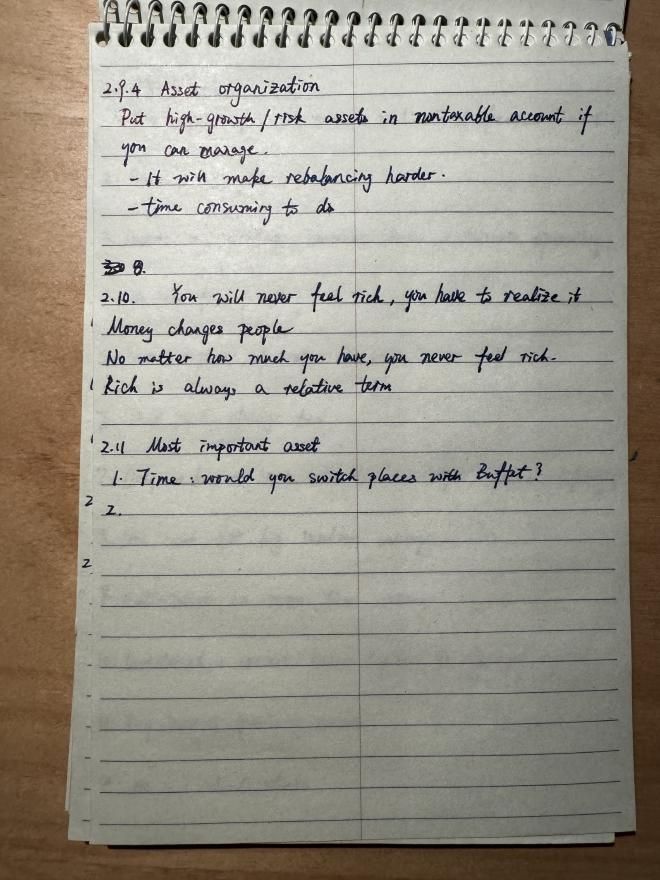

2.9.4 Asset organization #

- Theoretically: put high growth/risk assets in non-taxable account, low return/risk asset into taxable account

- It makes rebalancing harder

- Time consuming

- In reality, just forget it

2.10 Know you will never feel rich #

- Rich is a relative term

- No matter how rich you get, you will never feel you are rich

2.11 Most important asset is not money #

Time is the most important asset, would you switch places with Buffet right now?

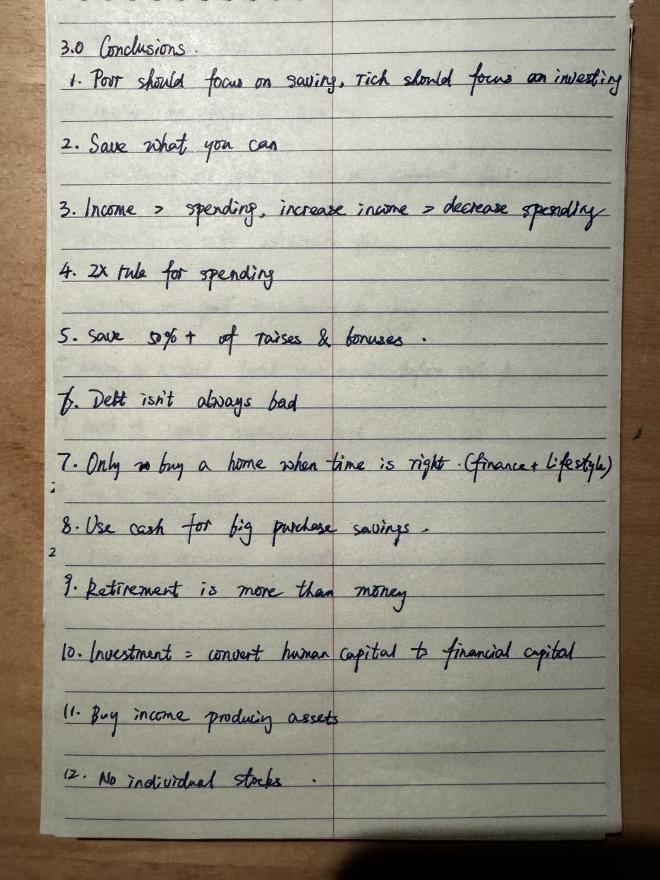

3. Conclusions #

- ‘Poor’ should focus on saving, ‘rich’ should focus on investing

- Save what you can

- Have more income more effective than limit spending

- 2x rule for spending

- Save 50+% of raises and bonuses

- Debt is a tool, it’s not always bad

- Only buy a home when time is right (finance + lifestyle)

- Use cash to save for big purchases

- Retirement is more than money

- Investment = convert human capital to financial capital

- Buy incoming generating assets

- Don’t pick individual stocks

- Buy quickly, sell slowly

- Invest as often as you can

- Investing is an act against bad luck

- Volatility is the admission fee of playing the game

- Crashes are good opportunities to buy

- Money is a tool, use it to get the life you want to live

- Rethink about maximize 401k

- You’ll never feel you are rich enough

- Time is the single most valuable assets of all